Small Business Loans

Get the financial support every startup or small business needs to grow. Work with a banking partner that's proud to partner with the SBA.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

How do you build financial security? Planning and education. A good place to get educated? Our library of free resources.

Have you enrolled in eStatements yet? Minimize paper clutter, maximize security and be good to the environment.

Small Business Loans

Get the financial support every startup or small business needs to grow. Work with a banking partner that's proud to partner with the SBA.

Government-backed and German American Bank-financed.

With more flexible loan structures. More time to repay loans. And less to put down upfront.

7A Loans

Line up the working capital your small business needs to seize the big opportunities ahead.

504 Loans

Heat up your business development engine with funding for commercial real estate or equipment.

Financial Resources

Access to security tools, CD calculators and more at your fingertips. View Resources

Financial Insights

Auto finance to home refinance, student checking accounts to IRAs – make informed decisions on all of it.

Imposters posing as your financial institution are trying to trick you and drain your accounts. Here’s what you need to know to avoid getting scammed.

Online shoppers are always vulnerable to scams, but increased web-based transactions throughout the holiday shopping season make these crimes more common. We're explore five common types of scams you could encounter around the holidays so you’ll know what to look out for and how to avoid them.

Recognizing these common signs of a scam could help you avoid one. Beware of the "5 Ps" that raise red flags a scammer may be trying to compromise your personal information or finances.

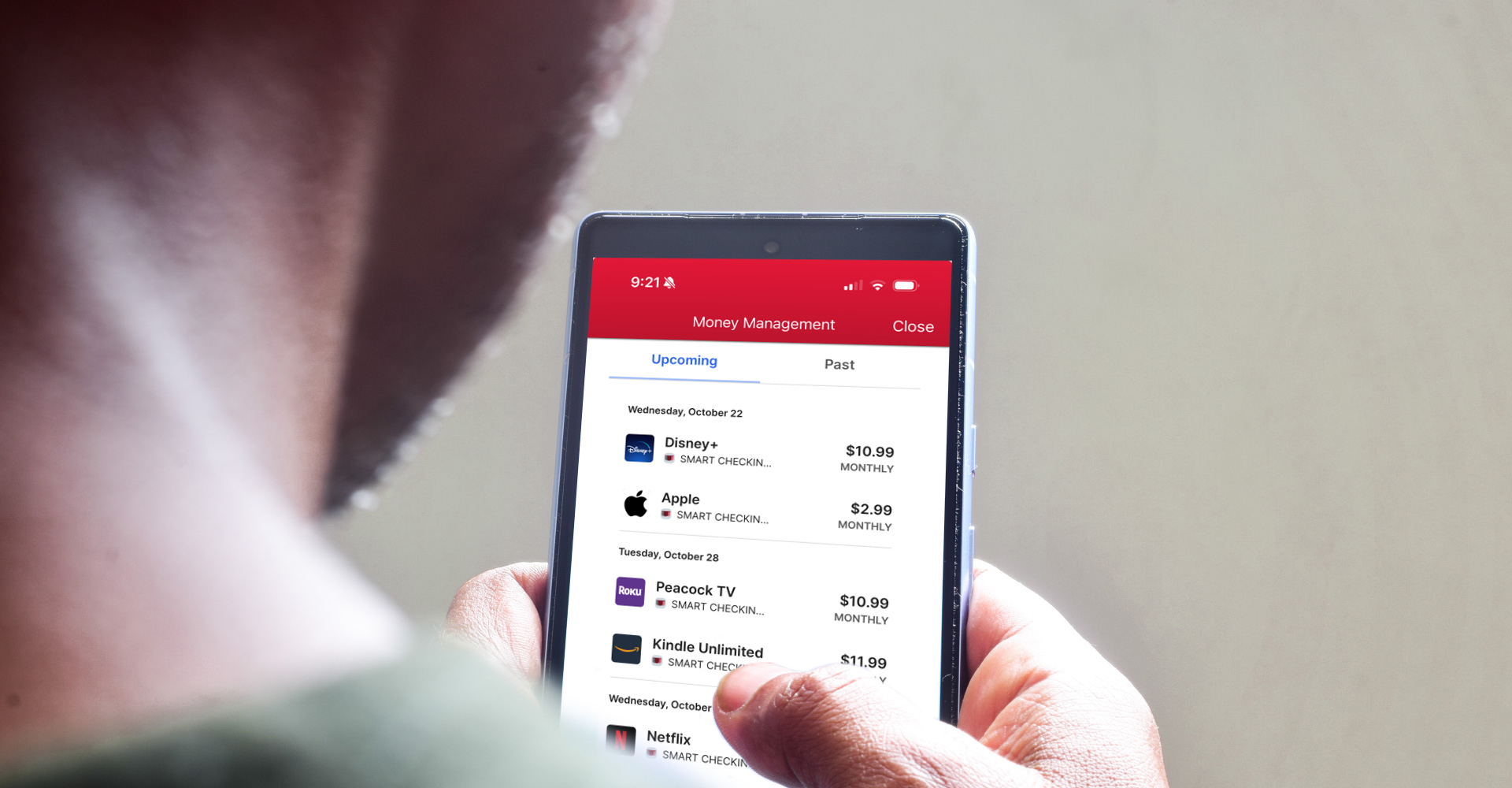

One way to get the most out of your budget is to reduce subscription expenses. Here are some things to consider when dealing with subscription expenses.

A new common scam tactic involves calling or texting using the bank’s name and number on the caller ID and posing as a bank employee to coerce you into providing sensitive information. Learn how this scam works and how to avoid it.

Searching for great vacation deals? Consider these strategies to steer clear of scams and hang on to your money.

Whether you’re a first-time home buyer, thinking about building, or taking steps towards purchasing an investment property, it’s important to start the process by being well prepared.

You might have heard of debt consolidation loans to help pay down multiple debts. You might have also wondered, what’s the difference between personal and debt consolidation loans? Here's what you need to know.

Taking steps to protect your personal information can help you avoid tax identity theft. Learn how to stay ahead of identity thieves with these helpful tips from the Federal Trade Commission.

The new year is a great time to conduct a financial checkup! Here are some things to review to get started on the right foot.

The digital age comes with many conveniences from managing your finances online to making purchases quickly and easily. With advances in technology come more sophisticated ways for scammers to get your hard-earned money. You can be fraud smart by safeguarding your payment methods and protecting sensitive data.

If you need cash for a large purchase, you might consider a Home Equity Line of Credit (HELOC), a type of loan that allows you to borrow against the value of your home. Learn more about the basics of how a HELOC works and general lender requirements.

Benjamin Franklin once said, “An ounce of prevention is worth a pound of cure.” There is no more appropriate mission statement when it comes to retirement and the potential surprises that might arise during this important life stage. Proactive prevention establishes financial awareness that will help mitigate these surprises and create retirement longevity for your investment portfolio.

German American Bank understands the importance of security and how costly a breach or scam can be to your business’s reputation and bottom line. The first line of defense is awareness. To help with your efforts in combatting fraud, here are two common business scams to watch for and ways to prevent them from the Federal Trade Commission.

When settling in to your new home, there are some important things you need to consider. ABA Foundation recommends the following tips.

Brush up on your mortgage knowledge by learning the definitions of these common home-buying terms.

According to the FBI’s 2023 Internet Crime Complaint Report, investment scams have skyrocketed. In 2023, $4.57 billion of losses were reported, with 90% being cryptocurrency (crypto) related. Learn about 3 popular scam tactics being used along with tips to avoid getting hooked by an investment scammer.

Your credit, your credit scores, and how wisely you shop for a loan that best fits your needs have a significant impact on your mortgage interest rate and the fees you pay.

Searching for your first home can be an exhilarating, yet overwhelming time in your life. If you are having trouble with where to start, you are not alone. With some guidance and organization, German American can help you be on your way to owning your first home. Here are some simple steps to get you started.

According to a recent survey, 30 percent of American adults say they don’t pay all their bills on time, causing them to pay extra interest and lofty late payment fees. Autopay and bill pay tools allow you to set up automatic payments for your recurring monthly bills. Understanding the details of how to make these systems do their best for you can help to save you money!

Before making the transition from renting your home to owning your home, it is important to start saving for a down payment, typically 5 to 20 percent of the home’s value. Check out some helpful tips from the American Bankers Association on how to save for it.

As you look forward to achieving new goals in 2024, German American Bank is here to provide the tools and resources you need to protect your financial well-being. We encourage you to be an active partner in preventing fraud and identity theft. Here are some healthy habits to be scam smart in the new year!

Encouraging financial education for young learners may be a way a good way to build a foundation of sound financial principles. Parents, caregivers, mentors, grandparents – anyone who has a positive influence over teens and young adults – can help them learn solid money lessons before they go off to college or get their first job.

You can be an active partner in preventing fraud by keeping your personal information safe. Learn how to protect yourself from criminals who may try to steal your personal or financial information with these helpful tips.

Moving into your own place can be exciting and frightening at the same time. The American Bankers Association suggests considering the following questions when choosing your own home.

It’s hard to learn the true value of money without actually having some money to save and spend. That’s why setting aside a specific amount each week as an allowance for your children can be a good way to show them, among other things, that cash is a limited resource.

An emergency fund is a vital part of healthy finances. If there’s one constant in life, it’s that it is not constant. Unexpected expenses appear out of thin air. You could suddenly find yourself unemployed. There is no way to see the future, which is why an emergency fund is so important. It provides a cushion should you stumble financially. Here’s everything you need to know about this fund.

Homeowners have several things to consider when it comes to finding needed funds for financing a project or consolidating debt. Two popular lending options are refinancing an existing mortgage or tapping into the equity in your home with a home equity line of credit. Let's explore the difference between the two!

As scams become more sophisticated, you may find yourself second guessing your actions when it comes your online activity or financial transactions. Should I click the link? Is that really my bank calling? Is this contest too good to be true? You can be an active partner in identifying potential threats and how to avoid them by being Fraud SMART. Be aware of these red flags to help protect your identity and your finances.

Seniors are increasingly becoming targets for financial abuse. As people over 50 years old control over 70 percent of the nation's wealth, fraudsters are using new tactics to take advantage of retiring baby boomers and the growing number of older Americans. Despite these threats, the American Bankers Association has provided some simple steps to safeguard personal information and be aware of warning signs that can protect aging men and women from financial abuse.

During April’s Financial Literacy Month, German American Bank partnered with Impact-as-a-ServiceTM education innovator, EVERFI, to host the fourth annual Financial Literacy Bee. This digital learning challenge enabled high school students to learn about important financial literacy concepts ranging from budgeting and saving to employment, income, investing, and insurance. Students ages 13-19 were able to compete to win one of $500 prizes by completing a capstone essay entry based on what they learned.

Fake checks continue to be one of the most common instruments used to commit fraud against consumers. Before you deposit a check you weren’t expecting or wire funds to an unknown recipient, check out these red flags from the American Bankers Association.

If you are thinking about starting some home improvement projects, you can be strategic about which ones to tackle first. There are some projects that net better returns than others. Learn about three home improvement projects that add plenty of value to your home.

Having a plan is the best start to financial success, with the first step being to create a budget! The key is to include as much information as you can, so that you can adequately prepare and plan. Include income, expenses, and how much you should be spending before putting it in writing and evaluating how well you're doing. Use the following guidelines from the American Bankers' Association Foundation to get started!

Your mobile device provides convenient access to your email, bank and social media accounts. Unfortunately, it can potentially provide the same convenient access for criminals. The American Bankers Association recommends following these tips to keep your information — and your money — safe.

What is credit and why is it important? What does it mean to be in debt? In what instances should you use credit? Find answers to these important questions, key words, conversation starters, and real world applications to start talking to your family about borrowing money and credit cards.

App Store

App Store

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

© 2026 German American Bank . All rights Reserved

© 2026 German American Bank . All rights Reserved

Our website uses cookies to improve your website experience and provide more personalized products and services to you. By using our website, you agree to the use of cookies.